What Went Wrong With Retirement

From Guaranteed Income to Maybe Money: How Retirement Was Stolen in Plain Sight

Welcome to the series of Retirement, Boomers, and Generations. This is Part II of three. You can find Part I here and III here.

The average boomer is between the ages of 61 to 79 years old.

That is close to doubling the amount of life I’ve lived, so I speak with complete reverence to those with a life long lived.

A couple of years ago, I started reading the book “FAKE” by Robert Kiyosaki, and it gave me some insight into how I see the world1. I’ve yet to finish it, but from what I recall:

It told the story of a boomer who talked about the old model of money (go to school, get a job, save for retirement).

The boomer benefited from the old way, but has realized that the old way is no longer beneficial.

There were other parts of the book, of course, but this part stuck out to me the most. This was the perspective of a boomer who had benefited from the old way of doing things. But they’ve seen that the old ways are no longer effective.

I imagine there are boomers in different buckets. Some have benefited from the old way, while others have been wronged by it. The goal of this article is to, one, get your feedback. Two, share my understanding of things, and three, to create dialogue between the many generations visiting this substack.

By fully understanding the information of a thing, we can know its essence. And once we do that, we can use that to control our reality.

So, without further ado, let’s dive in.

The Boomer and The Old Model

We’re going to break the boomer up into three parts: Early, Middle, and Late.

Early Boomers were born from 1946 through 1955, and their age range in 2025 would be from 70 through 79 years old.

Middle Boomers were born from 1956 through 1960, and their age in 2025 would be 65 through 69 years old.

Late Boomers were born from 1961 through 1964, and their age in 2025 would be 61 through 64 years old.

For decades, before and during the Boomer era, retirement was built on a three-legged stool2:

Pensions (guaranteed income for life from your employer)

Social Security (government safety net)

Personal savings (bank accounts, a mortgage-free home)

As I shared in my previous article on retirement, that model worked for my associate. He had the three-legged stool, and he and his wife are living a great retirement as they planned.

But this model didn’t work for everyone. And so now, we’re going to examine where this model began to fail.

First, we’ll touch on what I call the support system and then what I call the individual contribution. The support system includes the retirement support promised to retirees, which consists of pensions and social security, while the individual contributions are made through personal savings.

Here’s where retirement starts to fail.

How the Support System Got Dismantled

Let’s break down how each generation was affected by each stool leg, starting with pensions.

Pensions were retirement plans provided by companies to their employees. Example: You work 30 years at GM, and when you retire, they send you a guaranteed monthly check for the rest of your life.

Some boomers got pensions while others didn’t.

Early Boomers entered the workforce in the 1960s–1970s. During that time, pensions were still common in large companies, unions, and government jobs. Many members of this group still received pensions (at least those who remained with one employer for a long time).

Middle Boomers entered the workforce in the late 1970s to mid-1980s. They just caught the tail end of the pension era. Some had pensions, but many saw their employers begin shifting to 401(k)s (introduced in 1978 and took off in the 1980s). This group had mixed results, as some got pensions if they were in unionized/public jobs, but increasingly fewer in the private sector.

Late Boomers entered the workforce in the 1980s–early 1990s, exactly when corporations were cutting pensions and switching to 401(k)s. Most of them never got private pensions. Instead, they were told to fund their own retirements through 401(k)s and IRAs. Only those in government or public service roles (teachers, military, police, state jobs) still had pensions.

Pensions were guaranteed money from a corporation for life. This model puts all the onus on the company. In the 1980s through 1990s, corporations phased out pensions, replacing them with 401(k) plans.

This shifted all the risk from the company to the worker and involved investments that were influenced by external factors, such as market crashes and poor planning.

Workers now had “maybe money” instead of a guaranteed income.

Next, there was Social Security. Social security is a monthly income stream to individuals who have reached retirement age and contributed to the system through their payroll taxes. This system of social security is funded, meaning that if funding decreases, the system can’t continue to pay out as much.

Again, different groups benefited differently from this:

Early Boomers entered retirement in the 2010s–early 2020s and benefited from relatively stronger Social Security checks. They had a more favorable worker-to-beneficiary ratio (more workers paying into the system per retiree).

Middle Boomers are retiring now, in the 2020s. Hitting retirement as costs surge (housing, food, healthcare). Social Security is still available, but the benefit doesn’t keep pace with inflation, so it covers a smaller portion of their expenses.

Late Boomers are just reaching early eligibility (62) or still working. Face the harshest conditions: higher retirement ages (full benefits only at 67). By their full retirement age, the worker-to-beneficiary ratio will be even thinner, making sustainability a bigger question.

As we can see with the old model, both pensions and social security checks benefit some, while others may not receive any. Next is the personal savings leg. Savings is exactly as it says, personal savings. In addition to savings, you can also include assets. This was the individual contribution. And this was under what I call a direct attack.

The Attack on Personal Savings

Personal savings was the money that you saved over the years that could be touched by no one but yourself. If you paid off your mortgage, you would have an incredible asset that you could utilize as needed. This was the money that you had stored for yourself.

The direct attack on personal savings has come in one straightforward form: theft. And we’ll quickly show what occurred.

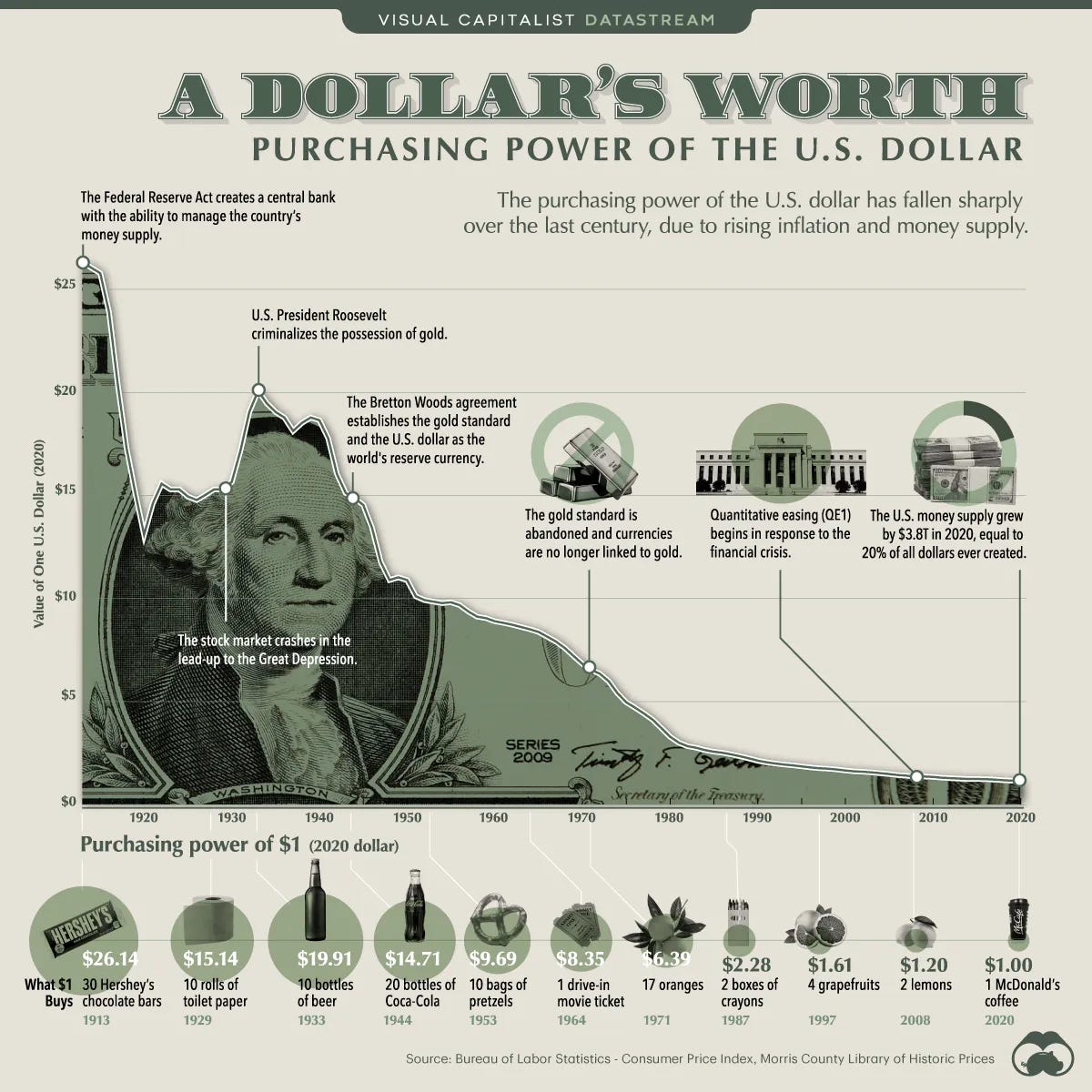

After the U.S. left the gold standard in 1971, money became “fiat.” Fiat currency is a government-issued currency that is not backed by a physical commodity, such as gold or silver. It is maintained through government regulation and monetary policy, typically controlled by a central bank.

These policies have ultimately led to inflation. Inflation in this term means rising costs. Whether it’s a lack of growth in wages or an increase in prices, the cost of living is rising, and due to monetary policies, the value of your saved income is worth less.

They’ve stolen your money.

Inflation has eroded the purchasing power of savings.

Where Do We Go From Here?

In my article on Democide and Menticide, I mention that democide—the killing of a people by their government—can be financial. Where it makes it financially harder for one to live.

What we’ve just described is how, financially, retirement, the care for our seniors, and their livelihoods, has been stripped away. Corporations stopped rewarding workers through pensions, and governmental policies have had a direct and indirect impact on social security.

The pandemic created an atomic bomb of financial disaster as it led to inflation, which allows someone like Trump to keep it going, only this time with tariffs. New name, but the essence is the same: rising costs.

All in all, our livelihood is being threatened, and it isn’t just our boomers who are under attack; it’s every generation after them. Gen X all the way to Generation Alpha.

But the good news is that we are aware of the problem. As one of my subscribers mentioned, “Retirement is a construct of modern times.”

Retirement is a construct of modern times—built on modern ideologies that are doomed to fail. Once we realize this, we can begin to explore those paths and forge new ones of our own.

Call it the awakening to the retirement illusion.

Takeaways

The timing of when you entered the workforce determined whether you got the “good deal” or got left holding the bag—it wasn’t about merit, just pure chance

What they called a three-legged stool was really a house of cards that started falling the moment corporations decided worker loyalty wasn’t profitable

Inflation is legalized theft that makes your saved money worth less every year while politicians pretend it’s natural economics

Retirement as we know it was always a temporary experiment that required endless growth and endless workers—both of which were impossible to sustain

Next Steps

Look at your own retirement plans and ask: am I depending on the same systems that failed others, or am I building something different?

For those not boomers, start conversations with the older people in your life about what actually happened to their retirement dreams versus what they were promised

Questions to Sit With

If the three-legged stool is collapsing, what about the other “stable” systems you’re building your life around?

For non-boomers, when you imagine yourself at 70, are you planning to be dependent on institutions that have already betrayed the generation before you?

I’ll close this article here, but I want to write another article called “How To Find Joy In Retirement.” For this topic, I will definitely need some feedback and insight from those who have experience with it—otherwise, I’d be relying on online research. So any feedback and commentary is greatly appreciated.

I’m learning a lot about this topic as I write, and it’s making me think about my future. Looking forward to learning even more from you all.

If this got you thinking, you might want to read my article on democide and menticide to understand how these financial attacks operate on multiple levels. Or dive into more of my work here on Unorthodoxy, where we examine the systems that shape our reality.

Thanks for the time and attention. Have a great and wonderful day.

Ashe,

Franklin O’Kanu

If you enjoyed this work and gained value from it, support more work like this by becoming a paid subscriber for $5/month

Related Content

Support Unorthodoxy!

If this article opened your eyes, there’s more behind the paywall. Exclusive, in-depth pieces that go deeper, challenge more, and reveal the truths they don’t want us to see.

🔑 Become a paid member and gain access to premium and archived articles, exclusive podcasts, and thought-provoking chats you won’t find anywhere else.

📖 Prefer a comprehensive take? My book, An Unorthodox Truth, is a fact-based journey through 200 years of deception—a must-read for those seeking clarity in a manipulated world.

☕ Feeling generous? Leave a simple tip to support this work—every bit helps me continue creating meaningful content.

Notes and References

I’m a fan of Roberts and follow his model of business and have written about how to not pay taxes in that article here.

In my previous article, I called it a four-legged-stool. I’m more certain it was more three than four.

The idea of doing a horrible job and then ending it in retirement should be relegated to the rubbish pile.

Retirement itself is largely horrible. At 70, do your new career, at 90, do another one. If you feel like it.

I am never intending on retiring. I’m a Middle Boomer, and I never worked for a big company nor do I know anyone who has, other than people who worked for the government and they definitely got a very generous deal.

But it’s time for people to love their work, and to want to keep working and not just sit around all day after a lifetime of productivity.

My Dad was an Investment Counselor who learned from his parents that the only true currency is gold and silver. He retired at 50 and has been living off his gold and silver investments since. He is now 91. I am finally seeing the truth in his wisdom. Money Masters is a great documentary and helped me to understand the financial system better. I was/am a stay at home Mom who's kids are grown, and I enjoy doing what I want when I want. I raise chickens, ducks and geese and prepare fresh food every day for myself and my Husband.