The Great Theft

A Complete Guide to the Financial Robbery of the American People

Introduction: The Invisible Theft

The fact that most accept inflation as a “natural economic force,” when it is literally wealth being transferred out of our pockets, shows the depths of the illusion within society.

While researching for this series, I began to see that this theft did not happen in isolation. It required tools to hide it, institutions to execute it, and psychological operations to keep us unaware.

The entire framework of modern economics - from the statistics broadcasted to us, to the Federal Reserve impacting our policies - was designed not to serve the people, but to extract from them.

One of the greatest robberies in American history happened over the past 50 years but accelerated within the last ten. Not with guns, not with masks (unless you include the COVID ritualistic masks), but with policy, statistics, and the manufacturing of belief.

This guide synthesizes over a month of research into a single document. It traces the crime from its earliest symptoms to its deepest roots, and finally to the liberation that becomes possible once you see the full picture.

Act One reveals the crime itself - what is being stolen, how to measure it, and why clear thinking is required to see it.

Act Two exposes the perpetrators - who designed this system, when they did it, and the specific documents that laid out their strategy.

Act Three presents the liberation - the suppressed economic reality that built the middle class, and the personal sovereignty that becomes possible when you reclaim your time.

To reclaim your wealth, you need to know how it was taken. And to do that, you must understand the complete architecture of the theft.

Here is the work I have written to illuminate it.

ACT ONE: THE CRIME

What Is Being Stolen and How to See It

Clear Thinking as Prerequisite

Why can you not focus on finances until you understand the value of thinking clearly?

You need to be able to reason and rationalize before diving into the world of finances because finances are one of the biggest areas where truth has been obscured by both sides of the political spectrum.

If you think vaccines have a huge religious following, wait until you see how oligarchs protect their financial narratives. The financial outlook is supported by whoever holds power, whether Republican or Democrat. Whoever is in charge will regulate statistics to paint a picture showing that finances are doing great.

This is the game. And this is why thinking clearly is required.

There is a critical distinction between country finances and personal finances. Statistics can paint a picture showing the country finances are thriving while your personal finances are drowning. Understanding how this sleight of hand works is essential.

Inflation since 1913, combined with other legislative acts, has systematically eroded what belongs to you. Do not judge your finances. Think about your finances. There is a profound difference.

What I reveal in the full article will forever change how you approach the statistics presented by institutions - and why both parties need you to keep believing.

Read: Before We Talk Money, We Have to Talk Thinking

------------------------------------------------------------

The Robbery Framing: Larceny vs. Violence

What if the distinction between larceny and robbery is the key to understanding modern economic extraction?

Larceny is simple theft: sneaky, quiet, nonviolent. Robbery, on the other hand, is far more damaging because it carries violence with it. Robbery is a felony. Larceny is a misdemeanor.

Under the premise of natural law, you can do whatever you want as long as you do not encroach upon me. You do not steal from me. You do not kill me. You do not harm me. This is how humanity should work. This is how nature works.

However, in our modern world, governments issue laws that depart from natural law. The argument I make is that governments and corporations are robbing us daily, but we are too distracted to see it. They are stealing from us daily, and it is sneaky but not violent. So we do not notice.

The economic strains most people are experiencing right now are undeniable. But what is interesting is that the economic strains we are dealing with right now are enough to make any previous human civilization throughout history revolt.

But we have not revolted.

Kingdoms figured out that if you give people enough perceived freedom, they will not revolt, and order can be maintained. Drug them with pharmaceuticals, entertainment, television. Operate the government under collectivism. These two elements ensure that the people are directed like soldiers while feeling like they are participating.

This is financial larceny operating at scale - and it has been happening since 1913.

Read: Introduction to Your Financial Awakening

------------------------------------------------------------

The $50 Bill Test: Making Theft Tangible

What if the most powerful way to see the robbery is through twenty $50 bills?

Most inflation discussions use percentages. “3% inflation.” “Prices are up 25%.” The truth is, these numbers are abstract. They do not reflect what reality encompasses.

However, when someone says, “This $50 used to buy this, and now it only buys half,” we can see we are not getting our money worth.

Let us run a simple exercise. Take $1,000 and divide it into $50 bills. That gives us twenty $50 bills. Now let us go back ten years.

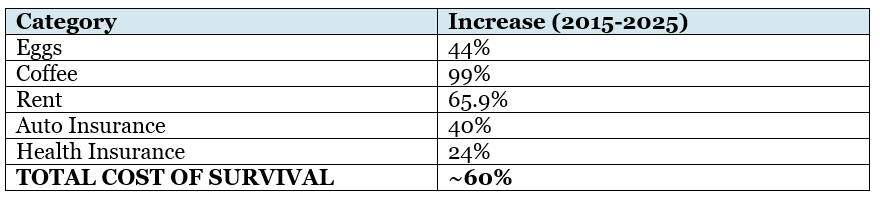

Between 2015 and 2025, the cost of basic necessities increased dramatically: Eggs up 44%. Coffee up 99%. Rent up 65.9%. Auto insurance up 40%. Health insurance up 24%.

What does this mean for that $50 bill? Your $50 bill has lost about $12 of its purchasing power. Ten dollars have been stolen from you, and you can only buy what $38 used to get you.

In 2015, one could make it with 38 $50 bills monthly. In 2025, they need close to 60 $50 bills just to make it by. The cost of survival has increased by approximately 60%.

If the median hourly rate is roughly $30, and one now needs an additional $1,000 just to survive, they are going to have to work almost another 40 hours. Another full week of labor.

This is not inflation. This is robbery. And it is happening everywhere.

Read: This Is Not Inflation. This Is Robbery.

------------------------------------------------------------

The Ten-Year Heist: Connecting the Architecture

What if every piece of the robbery - the statistics, the institutions, the belief systems - is connected?

When I first started examining inflation, I understood it only from its surface-level definition: rising prices. But by diving deeper, it became clear that inflation is more than economics. It is the visible symptom of a coordinated extraction system.

From the statistics used to obscure it, to the lobbyists who write the laws enabling it, to the Federal Reserve that profits from it, everything is connected.

The individuals who benefit from this system have sought to make it invisible. Einstein hid the aether. Rockefeller hid the wealth of oil. And the ruling class has hidden the mechanics of financial extraction behind economic jargon and statistical manipulation.

To understand the heist, you must understand its components:

Statistical Deception creates a fake lens of reality that severs trust in what your eyes can see. “Correlation does not equal causation” was forged in 1965 Congressional testimony by Darrell Huff while being paid by the tobacco lobby.

The Ruling Class writes the laws we obey while convincing us voting will change things. A 2014 Princeton study found average citizens have “near-zero” influence on policy.

The Federal Reserve is a private bank profiting from public debt while calling it “monetary policy.” From their own website: decisions “do not require approval by the President or anyone else.”

The Power of Belief sustains the entire system. Jerome Powell himself said inflation is sustained by collective belief. Your expectation of rising prices becomes a self-fulfilling prophecy.

The theft did not require guns or masks. It required policy, statistics, and the manufacturing of belief.

Read: The Ten-Year Heist: A Complete Guide to the Financial Theft of the American People

ACT TWO: THE PERPETRATORS

Who Did It, When, and How

How the American Dream Died in 1973

What if there was a specific year when the deal between workers and corporations was broken - and that year was 1973?

In 1931, the phrase “American Dream” was coined by historian James Truslow Adams, conveying a vision of a better, richer, and fuller life with opportunities for all. After World War II, the meaning shifted toward individual economic success - homeownership, a stable job, and upward mobility.

From 1948 to 1973, productivity rose by 96.7% and hourly compensation rose by 91.3%. Workers and corporations grew together. This was the “Post-WWII Social Contract” - an unwritten deal where corporations get stability and profits, workers get rising wages and security.

Several factors enabled this: union membership at 30%+, progressive taxation with top rates at 91%, and the Bretton Woods system limiting financial volatility.

Then 1973 happened.

Nixon ended Bretton Woods in 1971. The OPEC oil embargo hit in 1973. Wages hit a plateau. And critically, the NAIRU concept emerged - economists arguing that a certain level of unemployment was natural and necessary.

This reframed joblessness from a policy failure to a policy tool. The reserve army of labor disciplines workers into accepting less pay.

From 1973 to 2013, productivity increased 74% while typical worker compensation rose just 9%. The wealth went somewhere - just not to the people creating it.

The same playbook keeps running: world event, inflation, unemployment, workforce dilution. OPEC in the 70s. The pandemic in the 2020s. Once you see the pattern, you cannot unsee it.

Read: How the American Dream Died in 1973

------------------------------------------------------------

Why Big Business Attacked the American People

What if two documents - written in 1970 and 1971 - gave corporations the ideology and strategy to capture America?

Ralph Nader was a man for the people. In 1965, he exposed GM dangerous vehicles. GM responded by tapping his phone and hiring prostitutes to catch him in compromising situations. Nader sued, won $425,000, and used it to found consumer protection organizations.

But Nader unleashed the fury of Big Business. Two men gave corporations the tools to fight back.

Milton Friedman 1970 essay “The Social Responsibility of Business Is to Increase Its Profits” declared that businesses have no responsibility except profits. This gave corporations philosophical cover to abandon any pretense of social responsibility.

Lewis Powell 1971 confidential memo to the U.S. Chamber of Commerce was a 34-page battle plan. Go into the schools. Capture the courts. Influence the media. Use economic power as political power. Attack anyone who threatens the system.

Powell wrote: “There should be no hesitation to attack the Naders... Nor should there be reluctance to penalize politically those who oppose it.”

Two months after delivering this memo, Powell was nominated to the Supreme Court, where he served for fifteen years.

In 1973 - two years after Powell essay - stagnation occurred. For the first time in American history, worker wages stopped rising with productivity. The men who wrote the playbook became the referees.

This was deliberate, not inevitable. The economy is not a natural phenomenon. It is a set of rules. And those rules were consciously rewritten.

Read: Why Big Business Attacked The American People

------------------------------------------------------------

AI and Unemployment: The Modern Weapon

What if the same playbook from the 1970s is being deployed again - this time with AI as the accelerant?

My thesis is: unemployment is a tool used by corporations and the government to render the masses helpless and more dependent on the state.

LLMs are not artificial intelligence - they are advanced computing deployed at a strategic moment. After a pandemic left people isolated and lonely, they were given chatbots for companionship. The timing is not coincidental.

Our tech leaders are actually boasting about their ability to destroy jobs. Stanford computer science graduates are discovering their degrees no longer guarantee jobs. Tech companies are replacing 10 junior developers with 2 experienced engineers and an AI agent.

23% of Harvard Business School graduates are still unemployed three months after getting their degree. In 2022, that number was just 10%.

This mirrors what I have called “The Millennial Genocide” - how an entire generation is set up to fail financially while being told they are not working hard enough.

80% of all jobs in America do not serve humanity - they serve investors. Only about 24.5% of jobs are dedicated to essential functions: agriculture, healthcare, education, utilities.

The same characteristics keep appearing: world-class event, record inflation, unemployment, workforce dilution. The 1970s gave us OPEC and union-busting. The 2020s give us the pandemic and AI.

The divine spark of humanity is your competitive advantage. What makes humans irreplaceable is not efficiency - it is the soul. LLMs can imitate but never replicate genuine human essence.

Read: AI and Unemployment: The Tech Leaders Are Proud of Destroying Jobs

ACT THREE: THE LIBERATION

The Alternative and Personal Sovereignty

Deflation: The Name That Must Not Be Spoken

What if the economic process that built the American middle class has been deliberately erased from our vocabulary?

In myths and stories, there are certain names one must not speak, lest they herald the beholder. In Harry Potter, it is Voldemort. In economics, it is deflation.

Deflation is the decrease in the general price level of goods and services - the opposite of inflation. When society produces things better and more efficiently, prices naturally fall.

The period from 1870 to 1890 is known as The Great Deflation. During these two decades, prices fell gently but persistently, even as the economy grew. But here is what is crucial: wages did not fall with the prices.

Deflation is when money gains purchasing power over time. Your wages may stay the same, but because prices are falling, your money goes farther. You do not need a raise to live better.

This is where our American Dream comes from. One historian observed that the Great Deflation gave birth to the middle class because ordinary families could suddenly afford goods that had once been luxuries.

So why do we not understand this? Because of the history that has been given.

In 1913, the Federal Reserve was created. Prior to 1913, the monetary system had natural limits. After 1913, credit could expand endlessly. Debt became structural.

The Great Depression narrative has been weaponized to make us fear falling prices. But deflation itself is not the problem. Debt-dependent systems that cannot survive falling prices are the problem.

Deflation is not the enemy. It is the unknown possibility that threatens the debt-based system extracting your time and labor.

Read: “The Name That Must Not Be Spoken”

------------------------------------------------------------

Time Is Life: The Metaphysics of Money

What if the most fundamental truth about money is that it represents your life itself?

We have 60 seconds in every minute. And synchronistically, we have roughly 60 heartbeats per minute. When you run out of time, you run out of life.

Once we form this relationship between time and life, we begin to see that any attack on our time is an attack on our livelihood. Money is a token of time - the physical representation of time. I give you eight hours, and you give me compensation.

Since we have lost the understanding that time is life and money is the representation of time, we are robbed in deceptive ways we do not see.

Jordan Maxwell argued that modern financial and legal language is deliberately water-based. Money “flows.” Capital has “liquidity.” We speak of “currency” - from current. Control the channels, and you control the movement. Control the banks, and you control the current.

On land, law traditionally concerns people, boundaries, and fixed relationships. At sea, law governs movement and commerce. When modern commerce globalized, the logic of the sea quietly overtook the logic of the land.

Credit is debt. The instant a transaction occurs on credit, you have taken on debt - a legal claim on your future time.

According to the Federal Reserve, 90% of all money supply is credit. Entire industries do not just sell products - they service debt. Governments do not just govern - they budget around bond payments extending decades into the future.

Cash is king because cash eliminates debt from the start. Cash lives in the present. Debt colonizes the future.

------------------------------------------------------------

Wealth and Autonomy: The True Measure

What if everything you have been told about wealth is an inversion of its true meaning?

The etymology of “wealthy” means possessing wealth, being fortunate, good fortune. The original word “wealth” meant a state or condition of happiness, well-being, abundance. The starting point was metaphysical.

Due to this inverted system - this mind parasite known as the deadening that works through greed and deception - we have developed a specific view of wealth that is entirely material. Possessions. Keeping up with the Joneses. This is what gave rise to consumerism.

If money is a representation of time, then one who is wealthy is one who possesses an abundance of time.

A wealthy person is one who controls their time. How it is spent. When it is spent. People with high incomes but no control over their time are poor. Someone with modest resources but complete autonomy over their time is rich spiritually.

Autonomy over one time is the true definition of wealth.

What does personal deflation look like practically? Stop using debt. Start using cash. Delay purchases until prices drop. Wait until you can afford things outright.

When you control your time, you invest it strategically: learning, building, reflecting, experimenting. This produces more optionality, more abundance, than any high salary ever could.

That compound interest builds daily. Those blessings begin to accumulate. Happiness begins to accumulate. This is the definition of true wealth. And the best part? You can start right now.

Conclusion: The Choice Before Us

This guide has traced a single thread from symptom to cause to cure.

The symptom is the $50 bill that no longer covers your groceries. The 60% increase in the cost of survival. The extra week of labor required just to stay even.

The cause is a system deliberately designed in the 1970s - through Friedman ideology, Powell strategy, and the weaponization of unemployment - to extract wealth from workers and channel it to corporations and shareholders.

The cure is the reclamation of your time through personal deflation, the rejection of debt-based living, and the recognition that true wealth has always been measured in autonomy, not accumulation.

The system requires your participation to function. Powell said it directly - inflation is sustained by collective expectation. Withdraw the belief, and the illusion loses power.

The cage they built around this topic - made of statistical manipulation, lobbying, the Federal Reserve extraction, and social programming - has cracks. And those cracks are growing.

You now have the map. You know how the crime was committed. You know who committed it. And you know what liberation looks like.

The only question remaining is: what will you do with this knowledge?

Knowledge only becomes power when it is applied.

Takeaways

The heist is not hidden - it is obscured by language. “Inflation,” “monetary policy,” and “economic forces” are euphemisms for wealth transfer. Once you translate the jargon, the crime becomes visible.

1973 was the breaking point. Before that, productivity gains flowed to workers. After that, the gains flowed to shareholders and executives while wages flatlined. This was not market forces - it was policy choices.

Both parties protect the “economy is great” narrative. Statistics are curated to paint prosperity regardless of who holds power. Neither side is stopping the robbery.

Unemployment is a weapon, not a byproduct. The same playbook from the 1970s - world event, inflation, unemployment, workforce dilution - is being deployed again with AI as the accelerant.

Deflation built the middle class. When your money goes further without wages necessarily increasing, you gain ground. Personal deflation strategies are your defense against the inflationary system.

The true definition of wealth is metaphysical. Autonomy over your time is the real measure - not your salary, not your possessions. High income without time freedom makes you poor.

The system requires your belief to function. Withdraw the belief - stop using debt, start using cash, delay purchases, invest in time autonomy - and the system loses its grip on you.

Knowledge only becomes power when applied. Reading this guide changes nothing. Implementing personal deflation systems, auditing your debt exposure, and reclaiming your time changes everything.

Next Steps

Run your own $50 bill test. Take your 2015 monthly expenses and compare them to today. Calculate how many additional $50 bills you now need. Make the robbery tangible.

Audit your debt exposure. List every obligation that claims your future time - mortgages, loans, credit cards, subscriptions. See the total claim on your future.

Switch to cash for discretionary spending. Start with one category (groceries, entertainment) and expand from there. Feel the difference between immediate settlement and deferred obligation.

Calculate your time autonomy. How many hours per week do you actually control? That number is your real wealth indicator.

Read the primary sources yourself. Friedman essay is available online. The Powell Memo is archived at Washington and Lee University. See what they actually wrote.

Audit your labor against the 80/20 framework. Does your job serve human flourishing or corporate extraction? Be honest about where your life force flows.

Identify one human-centered skill you can develop. Whether it is hands-on skills, caregiving, or creative work - begin building something AI cannot replicate.

Track where your belief is invested. For one week, notice when you accept a narrative without verification. Who benefits from your belief? What would change if you withdrew it?

Related Content

The articles synthesized in this guide, organized by act:

ACT ONE: THE CRIME

* Before We Talk Money, We Have to Talk Thinking

* Introduction to Your Financial Awakening

* This Is Not Inflation. This Is Robbery.

* The Ten-Year Heist: A Complete Guide to the Financial Theft of the American People

ACT TWO: THE PERPETRATORS

* How the American Dream Died in 1973

* Why Big Business Attacked The American People

* AI and Unemployment: The Tech Leaders Are Proud of Destroying Jobs

ACT THREE: THE LIBERATION

* “The Name That Must Not Be Spoken”

FOUNDATIONAL ARTICLES (Referenced Throughout)

* Statistical Deception: The Great Travesty upon the Tapestry of Human History

* Democide and Menticide: Two Unknown Hidden Terms Impacting Society

* Understanding The Ruling Class of The United States, Parts 1 and 2

* The Federal Reserve Plan For Inflation Will Bring Pain to Americans

* The Power of Belief: How Our Collective Belief Upholds Society Narratives

* The Comfortable Cage of Our Modern Slave Plantation

* Humanity vs The Deadening: Part Two - Society Spiritual Infection

* Profits Over People: The Corporate Illusion and the Cost to Humanity

Ready to See the Full Picture?

These article summaries are just the entry point. Behind the paywall lies the complete documentation of how the heist was executed: the full articles with sourced evidence, the historical connections, and the practical framework for protecting yourself.

The full archives contain the specific mechanisms of statistical manipulation, the documented lobbying expenditures, the Fed own admissions, the 80% labor data, and the spiritual framework for understanding why these forces operate as they do.

For less than the cost of a single coffee per week, you gain access to the unorthodox truths that could fundamentally reshape your understanding of where your wealth has gone - and who took it.

The question is not whether you can afford to subscribe - it is whether you can afford to keep losing 18 percentage points of purchasing power while believing it is “just inflation.”

Because your wealth does not return until you understand how it was taken.

Become a paid subscriber for $5/month and unlock the full truth

As always, thanks for the time and attention. Have a great and wonderful day.

—Ashe,

Franklin O’Kanu

If you’re already aware but want to take a step toward becoming the best human you can be, you can check out my guide.

11 Insights for Being The Best Human This 50-page guide is the clearest map I’ve created for navigating the madness of modern life. It blends ancient wisdom, spiritual clarity, and grounded daily ritual — helping you remember who you are and why you’re here.

If the world feels off, this guide will confirm why — and help you take back control.

Want to go deeper on what’s really affecting our physical health?

The Master Reference Guide — A comprehensive, fact-based resource on what’s actually in these vaccinations, what the data shows, and what’s been hidden from public view. Built for those who want the full picture.

The Parent’s Guide to Recognizing Severe Reactions — If you have children that have been vaccinated, this is essential. Learn to identify the warning signs that get dismissed, misdiagnosed, or reclassified. Because knowing what to look for can change everything.

Support Unorthodoxy!

If this article opened your eyes, there’s more behind the paywall. Exclusive, in-depth pieces that go deeper, challenge more, and reveal the truths they don’t want us to see.

🔑 Become a paid member and gain access to premium and archived articles, exclusive podcasts, and thought-provoking chats you won’t find anywhere else.

📖 Prefer a comprehensive take? My book, An Unorthodox Truth, is a fact-based journey through 200 years of deception—a must-read for those seeking clarity in a manipulated world.

☕ Feeling generous? Leave a simple tip to support this work—every bit helps me continue creating meaningful content.

A lot of good, valid material here. Although I have only read the summary here, it seems to me that that there are two points that are under-emphasized: first, closing the gold- window in 1971 was actually the key catalyst. That allowed for unlimited money printing (the original, more correct definition of inflation, ie, an increase in the money supply which leads to higher prices); and second, the lack of enforcement of monopoly regulations which permitted the development of super-large predatory businesses.

Thank you. Explained with your usual lucidity.

Americans should ponder how they managed not to have any inflation for 150 years.

They are both evil and very clever. The unthinking mass never wonder why we have inflation.

I have never heard others on public transport think about the why. Instead, it is dogs and the weather - and never chemtrails, except among the band of truthers. Easy meat for predators.

Still hoping for the Great Awakening!